AI-Powered Chatbots: Transforming Customer Experience in Fintech

Table of Contents

In the fast-evolving world of fintech, customer expectations are at an all-time high. They demand quick, accurate, and personalized support that traditional systems often struggle to provide. Enter AI-powered chatbots, the game-changer transforming how financial institutions interact with their customers.

From handling queries in seconds to offering tailored financial advice, chatbots are redefining the customer experience. Let’s dive deep into their role, benefits, and future in the fintech landscape.

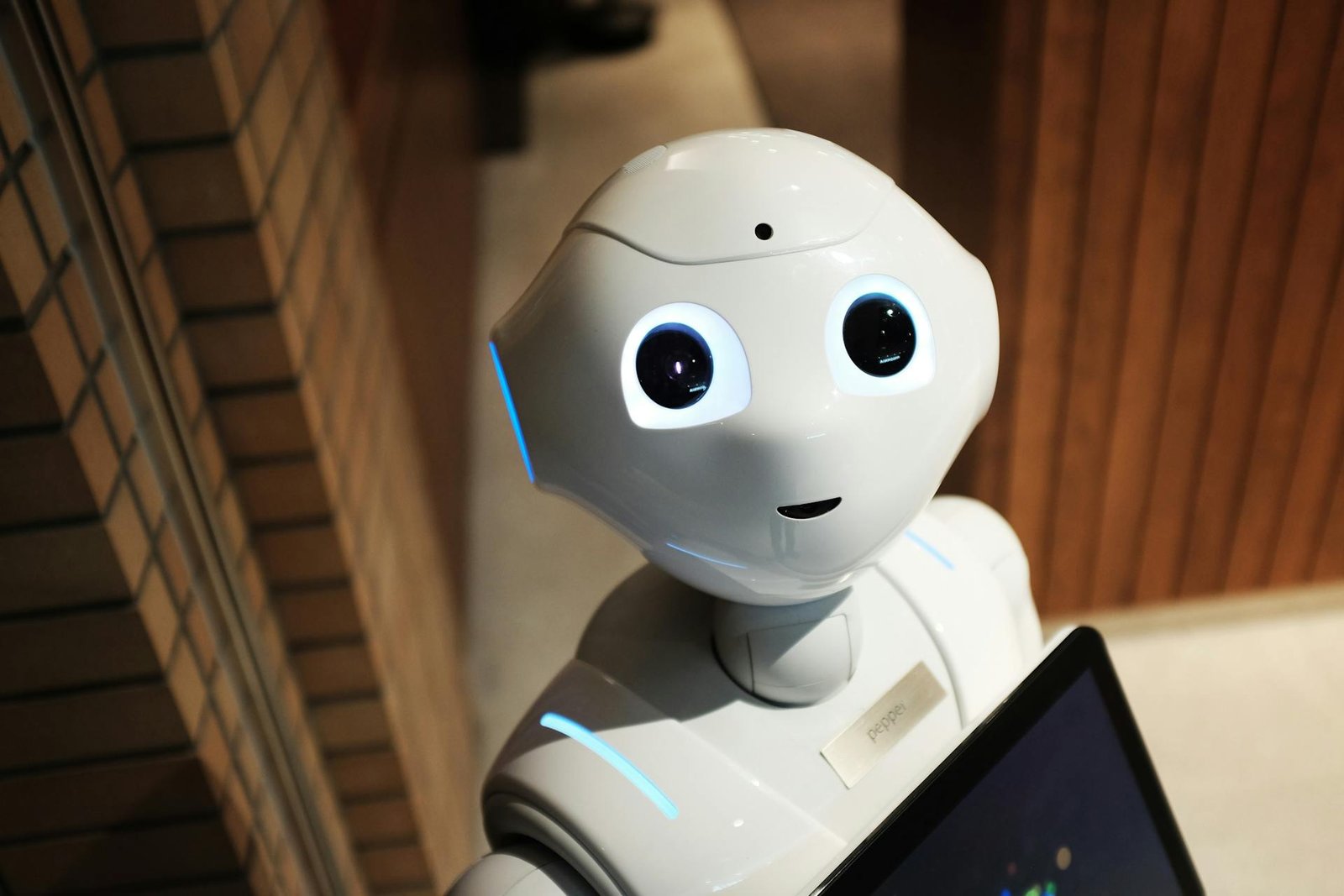

Chatbots using artificial intelligence (AI) are clever programs created to mimic human speech. They use machine learning and natural language processing (NLP) to comprehend and reply to consumer questions.

In fintech, these chatbots handle tasks like:

-Resolving account-related issues

-Providing personalized investment recommendations

-Assisting in loan applications

Unlike traditional chat systems, AI chatbots improve with every interaction, making them an invaluable asset for fintech companies aiming to stay competitive.

The Role of Chatbots in Fintech

AI chatbots in fintech bridge the gap between automation and customer service. Here’s how they play a pivotal role:

Real-time Support: Because chatbots are available around-the-clock, clients may get assistance whenever they need it.

Transaction Support: From transferring funds to paying bills, chatbots streamline financial tasks.

Personalized Experiences: Using data analytics, they provide insights tailored to individual financial goals.

Fraud Prevention: Chatbots can detect unusual account activities and alert customers instantly.

Their seamless integration into mobile banking apps and websites enhances user satisfaction while reducing operational costs.

Benefits of AI-Powered Chatbots in Fintech

Here’s why chatbots are the cornerstone of a superior fintech customer experience:

Cost-Efficiency: Automated responses reduce the need for large customer service teams.

Speed: Immediate responses keep customers engaged and satisfied.

Scalability: Chatbots can handle thousands of queries simultaneously, something human teams cannot achieve.

Accuracy: AI algorithms minimize errors in resolving customer queries.

Chatbots ensure better service overall by automating monotonous operations, freeing up human agents to concentrate on complicated issues.

Key Features of Fintech Chatbots

Fintech chatbots come equipped with cutting-edge features:

Voice Integration: Many chatbots now support voice commands, offering hands-free convenience.

Multilingual Support: Cater to global customers by communicating in multiple languages.

Secure Transactions: Built-in encryption ensures sensitive data remains safe.

Data-Driven Insights: Chatbots collect valuable data to improve services and offer better financial advice.

These features make them indispensable in providing a seamless fintech customer experience.

Popular Use Cases of AI Chatbots in Fintech

Let’s explore real-world applications of chatbots in the financial industry:

Banking Assistance: Customers can check balances, transfer money, and manage accounts via chatbots.

Investment Guidance: Robo-advisors powered by AI suggest investment options based on user preferences.

Loan Applications: Chatbots simplify loan applications, guiding users through the process step-by-step.

Insurance Claims: Automated systems streamline the claims process, making it faster and more transparent.

The versatility of chatbots ensures their relevance across various fintech services.

Challenges in Implementing AI-Powered Chatbots

While the benefits are significant, there are challenges:

Initial Costs: Developing and deploying AI chatbots require substantial investment.

Data Privacy Concerns: Handling sensitive financial information demands strict compliance with regulations.

Complex Queries: Advanced NLP capabilities are required to handle intricate customer problems effectively.

Despite these hurdles, the advantages far outweigh the challenges when implemented strategically.

The Future of Chatbots in Fintech

The capabilities of chatbots will advance along with AI. What lies ahead is as follows:

Hyper-Personalization: Chatbots will offer even more tailored solutions based on real-time data.

Proactive Engagement: Instead of waiting for customer queries, chatbots will initiate conversations.

Integration with Emerging Technologies: Expect deeper integration with blockchain and IoT for enhanced security and functionality.

The future is bright for AI-powered solutions, particularly in the ever-innovative fintech sector.

Conclusion

AI-powered chatbots are reshaping the customer experience in fintech, delivering speed, accuracy, and personalization at scale. By adopting these intelligent systems, financial institutions can meet the demands of today’s tech-savvy consumers while staying ahead of the competition.

As the technology matures, its applications will only expand, making chatbots a critical component of any fintech strategy.

What are AI-powered chatbots used for in fintech?

AI chatbots assist with tasks like account management, financial advice, and fraud detection, enhancing the overall customer experience.

Are AI chatbots secure for financial transactions?

Yes, modern chatbots use encryption and comply with financial regulations to ensure data security.

How do chatbots improve fintech customer support?

Chatbots provide real-time assistance, handle multiple queries simultaneously, and offer personalized solutions, significantly improving customer support.

Can chatbots handle complex financial queries?

Advanced chatbots with NLP capabilities can address complex queries, but human agents may still be needed for highly intricate cases.

What is the future of AI chatbots in fintech?

The future includes hyper-personalized experiences, proactive customer engagement, and integration with emerging technologies like blockchain.